June 24, 2025

5 Tips for Low-Effort Budgeting

By : Ellie Brown

Everybody wants life to look as simple as it can. You, too, want to save money, but without engaging in the complications of it. You may have a bad month regarding savings. It might discourage you from saving and achieving budgeting goals. However, it is not the end of the world.

You can save money without being affected by emergencies. The blog lists some productive and easy ways to budget well without investing much effort. It is ideal for individuals new to budgeting or those with time constraints to prepare one.

How to save money without hassle?

Whether saving money for something important or to be on top of the bills, budgeting always helps. Sticking by a particular financial plan to manage money means spending less than what you do now.

It is about ensuring discipline in the expenditure, saving, and investing aspects. Good budgeting is the key to achieving your dreams in a timely. It helps you save more money by cutting on non-essentials. Here are some tips which may help you with low-effort budgeting:

Step 1- Analyse the current financial situation

Book yourself some time to look back on the existing financial set-up. Identify your monthly income, expenses, liabilities (mortgage, car loan), credit cards, etc. Check and add up both fixed (electricity, rent, groceries) and variable expenses (refuelling gas, examination fees, car repair). Apart from this, analyse the amount you spend every month on discretionary expenses like shopping, dining out and movies.

Once you have a clear overview of the wants, needs and urgent expenses, create a budget. Identify which of the things are critical to your lifestyle and plan these first. Later, develop a plan to reduce the discretionary expenses.

Step 2- Identify the best budgeting system

Every individual’s finances and life goals are different. Therefore, the budgeting or money management strategies may also differ. Here are some popular strategies to plan a budget:

- Zero-based budgeting – Using every single penny towards a purpose

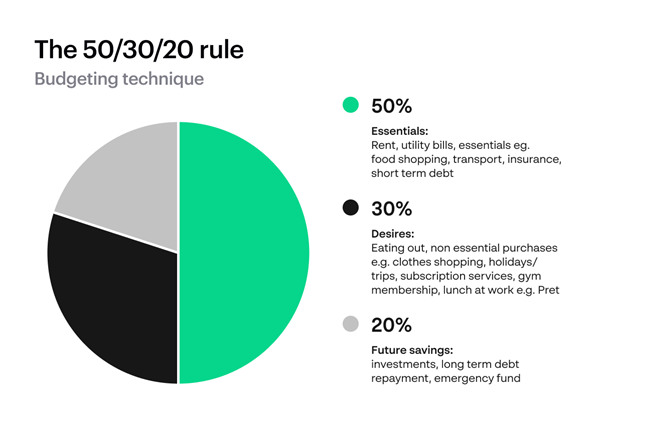

- 50/30/20 budgeting- splitting the income into needs, wants and savings

- Envelope budgeting- Setting up envelopes for different life needs

In this, one of the most popular ways of budgeting is 50/30/20. This rule involves splitting your after-tax income into wants, needs and savings. Here, 50% goes towards the needs, 20% towards the needs, and you save 30% of your income later.

It is just about knowing and specifying the wants and needs clearly. It will help you understand the requirements correctly and save more. Here is how a 50/30/20 budget looks:

|

Needs (50%) |

Wants 30% |

Savings 20% |

|

50% of your income goes towards the absolutely important bills

|

30% of your income goes towards something that’s not essential

|

20% of your income goes towards your total monthly savings

|

|

Credit card payments |

Ott subscription |

Emergency fund |

|

Rent |

Movies |

Retirement fund |

|

Utility bills |

Dining out |

Equities |

|

Groceries |

Weekend gateways |

Savings account |

|

Debt payments |

Shopping |

Insurance |

For example, if you get £45000 after tax, your spending towards needs, wants, and savings should be:

- Needs- £22,500

- Wants- £13,500

- Savings- £9000

Note: The amount you must save towards each aspect may vary according to your income. Accordingly, a zero-based budget is for individuals with a paycheck-to-paycheck lifestyle. You must dedicate every pound by prioritising spending.

Lastly, envelope-based budgeting is for individuals who are new to budgeting. Pick the right budget plan according to your needs, income, and lifestyle goals. You can even take the expert’s help or use free budgeting tools to understand it better.

Step 3- Identify areas to save more

Tracking expenses is critical to understanding the best ways to save more. You can do that by creating an Excel sheet, a PowerPoint presentation or using a free budgeting tool. You can easily cut costs on the daily expenses. If you want to know how, read ahead:

- Groceries- Plan a meal a week in advance and ensure the required ingredients

- Subscriptions– Cut the unused ones and check the cheaper alternatives

- Utilities- check a cheaper rent, cable, gas, telephone and mobile contract

- Emergencies– Set up an emergency fund to avoid spending more

- Credit cards– reduce the credit card usage and stick to the important ones

- Transportation– check travel and transportation cards for routine conveyance

Alternatively, you can check the best ways to use debt to save money. For example, consolidate some of your pending payments into a single instalment monthly. It is an ideal arrangement for individuals dealing with over 8 bills monthly.

If you have been late or missed payments, consolidation may help. It helps you pay on an instalment and reduces the interest and total payable amount. You can use the money saved for other critical life goals.

Step 4- Automate your savings

It is one of the best ways to walk towards your goal of consistent savings. You can set a direct debit for savings from your bank account. It helps you save money after making the necessary payments. You don’t need to budget for the money manually.

Instead, it automatically saves money towards the desired savings mode. For example, you can set a direct debit from your bank account for an emergency fund, equities, or savings account. However, don’t tap the emergency fund for every small need.

It may hamper the returns that you build over time. Instead, if you encounter any cash emergency, rely on quick loans on the portal. It is a cheap, fast, and safe way to counter any critical need. You may get the money in your bank account on the same business day.

Step 5- Review and change the budget periodically

Budgeting is not just about saving money. It is about optimising the path to achieving your goals. You can save money for the much-needed life changes like buying a home, a wedding or starting a family.

Review the budget on time and adjust it to meet your current goals. Your income and liabilities may shift, and so may your savings. Not optimising the budget according to your new requirements may not be ideal for your finances. It may hamper overall personality growth.

Bottom line

These are some step-by-step tips to follow to set up a budget and save money effortlessly. Anyone new to budgeting, income, and investments may benefit from this. It is all about knowing your finances and approaching a healthy version of money management. You may find it challenging initially. However, it turns out super easy once you crack it.