August 30, 2025

What Is A Signature Loan? Everything About It

By : Ellie Brown

A signature loan lets you borrow cash with just your name on paper. You don’t need to offer your car or house as backup. The lender trusts that you’ll pay them back based on your word. They check your income and credit score before saying yes.

These signature loans have become quite common in towns and cities. Many people get approved in just a few hours after applying. This quick process helps when you face sudden money troubles.

Many banks and online lenders now offer many signature loan choices. People with better scores get cheaper deals on their loans. Most banks will lend between £1,000 and £25,000 this way.

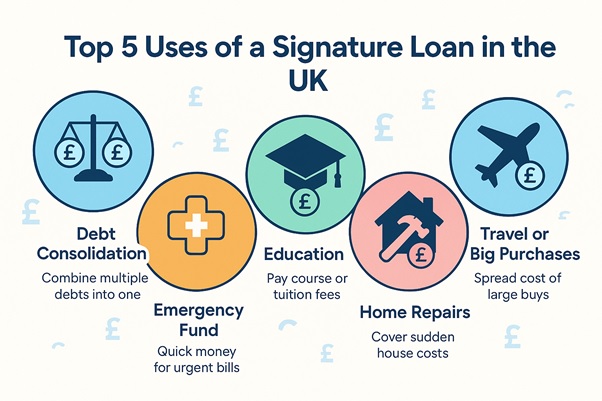

These loans work well for many life needs and wants. Some use them to pay off high-cost credit card bills. Others fund home fixes or buy new cars with the money. Many keep these loans as a backup plan for surprise costs.

What Is a Signature Loan?

A signature loan lets you borrow money based just on your promise to repay. You don’t need to put up your house or car as backup. These loans, also known as unsecured personal loans, work differently from secured ones.

Most banks and online lenders offer these loans. The amount you can get depends mostly on your income and credit score. The lenders want to make sure you can pay them back on time. You can use this cash for almost anything. Many people use it to pay off credit cards, fix their homes, or cover big bills.

- Loan terms usually range from one to seven years

- Interest rates tend to be higher than those for secured loans

- Approval can happen within 24 hours in many cases

- No risk of losing property if you can’t pay

- Monthly payments stay the same throughout the loan

The lender will check your income and how much debt you already have. Many people find these loans helpful when they need quick money without any fuss.

| Signature Loan Interest Rate Range in the UK | |

| Credit Rating | Typical APR Range (2025) |

| Excellent (750+) | 5% – 10% |

| Good (700–749) | 10% – 15% |

| Fair (650–699) | 15% – 25% |

| Poor (600–649) | 25% – 40% |

| Bad Credit (<600) | Depends on the direct lenders |

How Does It Work?

You’ll need to share details about your job and monthly pay. The lender then runs a check on your credit history. This helps them decide if they can trust you.

They’ll offer you a loan deal if things look good. You’ll see how much money you can get and what it costs. Most loans come with clear terms about when to pay back. You sign the papers, and the money goes to your bank account.

The whole thing can take one day. Many lenders now let you apply online from home. You won’t need to visit a branch or talk to anyone face-to-face.

- You’ll get a payment plan showing what to pay each month

- Most loans have fees if you miss payments

- Some lenders give better rates for setting up auto-pay

- You might pay less if someone cosigns with better credit

- Early payoff could save you money on interest costs

After approval, the cash usually arrives within a few days. Then you just need to keep up with the agreed monthly amounts. Your final payment marks the end of your loan agreement.

Features of Signature Loans

Signature loans don’t ask for any backup items. You won’t need to risk your flat or motor as loan safety. Many borrowers use signature loans as an instant emergency fund for urgent bills.

Fast Money When You Need It

Most lenders can put the funds in your account very fast. Some offer same-day payment if you apply early. This makes these loans perfect for sudden costs like car fixes. You won’t have to wait weeks while bills pile up.

Use It How You Want

You can spend this money freely, unlike some loans with strict rules. Want to fix your kitchen? Take a much-needed break? Pay for a course? Use it as a debt consolidation loan? The choice is yours.

Clear Payment Plans

You’ll know from day one exactly how much to pay each month. Most loans are between one and seven years in the UK. This helps with planning your budget without any nasty shocks.

Simple Approval Steps

The whole process takes just a few steps without tons of paperwork. The lenders mainly want to see that you have steady work. Your credit past matters too, but some will still help if yours isn’t perfect.

Signature Loan vs Other Loans

Signature loans offer good traits that set them apart. They give you cash without asking for your house or car as backup. You can get unsecured loans for bad credit from a direct lender as signature loans.

Less Risk Than Secured Options

Secured loans ask you to put up something you own. If you can’t pay, the bank can take your stuff. You don’t face this worry with signature loans.

Better Terms Than Quick Cash Fixes

Payday loans might seem easy with their fast cash. But they charge huge rates that can trap you in debt. Signature loans give you months or years to pay back. The monthly cost stays low enough to fit in most budgets.

More Structure Than Credit Cards

Credit cards let you spend as you please up to your limit. This can lead to debt that grows over time. Signature loans come with a clear end date. You know from day one when you’ll be debt-free.

Who Should Take a Signature Loan?

Signature loans work best for folks with clean credit histories. These loans make sense when you need cash for a clear goal. Many people choose these loans to merge other debts into one payment. This can sometimes save on interest fees. The fixed monthly cost helps you plan your budget with no surprises.

You might find cheaper options if you own a house with good equity. Secured loans against your property often have lower rates. The payments must fit into your monthly spending plan.

The young adults building credit might start with a small signature loan. Paying it back on time helps boost their credit rating. This makes future loans cheaper and easier to get. Shoppers seeking very large sums might need to look elsewhere. Most signature loans take out £25,000.

Conclusion

Signature loans work best for those with decent credit and steady jobs. The clear payment plan helps you know exactly when you’ll be debt-free.

You always shop around for the best rates. A small rate drop can save you hundreds over time. These loans can help smooth life’s rough spots. They bridge gaps between what you need and what you have saved.