November 18, 2025

Short-Term Loan Help for Families Living Only on Child Benefit

By : Ellie Brown

Your fixed income remains as it is, and prices increase on all you have to buy. The loans for people on benefits seem to offer quick fixes. They offer cash in your pocket when you have weeks without the next pay. The advert is all easy and stress-free. You miss an opportunity to feed your children and keep the light bulbs running.

This guide should demonstrate to you how to overcome money troubles. We take time through processes that are free, then proceed to borrow. You will have straightforward information regarding assistance that most parents overlook.

Why Families on Child Benefit Struggle with Cash Flow?

Your money comes on set dates each month, and bills come up any time. This timing gap often leaves your wallet empty when you need cash most.

The rising cost of daily needs hits your budget hard. Food prices jump higher each month at local shops. Rent takes a bigger chunk of your money than ever before. The costs catch you off guard when your child gets sick. These costs show up with no warning, and you can’t wait until your next payment.

Most banks turn you away when you need help most. Your credit score suffers when you live on benefits alone. This pushes you toward high-interest loans that make things worse in the long run. Some direct lenders offer loans with no need for a good credit score or a second person to back you up. You can easily get very bad credit loans with no guarantor from a direct lender. This won’t require you to have a guarantor for loans.

- Your income stays fixed while costs keep rising

- School terms bring extra spending at the worst times

- Winter bills hit harder than summer ones

- Birthdays and holidays strain your budget beyond its limits

- Single parents face twice the strain with half the help

A broken phone means no way to call about jobs. A missed bill leads to late fees you can’t afford. This cycle traps you in a cash flow nightmare that feels endless.

When a Short-Term Loan May Help?

You need it fixed now when your washing machine dies. Dirty clothes pile up while you wait for your next payment. A quick loan bridges this gap and keeps family life running.

School trips come with short notice and firm deadlines. Your child’s face drops when they think they’ll miss out. A small loan means they join friends instead of staying alone.

If someone close to you falls ill in another town, you must go. Train tickets cost more than what you have in your account right now. The right loan helps you be there when it matters most.

Doctor visits sometimes lead to meds not covered by health care. Your child’s health can’t wait until next week when money comes in. A loan means they get better sooner rather than suffering longer.

The final days before your next benefit payment stretch the longest. Your fridge sits empty while bills demand payment. A short-term loan fills this gap and puts food on your table when cupboards are bare.

Emergency dental work brings pain to both mouth and wallet. Your tooth aches, but your bank account hurts worse. A fast loan ends the pain without weeks of waiting and worry.

| Safe Vs Unsafe Loans | ||

| Type | Safe Sign | Unsafe Sign |

| FCA lender | clear fees | unclear words |

| Credit union | fair rates | very high APR |

| Local loan shop | set terms | push rollovers |

| Online lender | secure site | no licence |

Safer Options Before Taking a Loan

Your first step should never be a loan. Several free help paths exist that won’t add to your worries.

Ask For Payment Plans

The majority of stores and facilities are interested in retaining your business. You can freely discuss with them the need to cut your bill in half. School uniform stores usually allow you to pay in instalments prior to the beginning of the term.

Check Local Council Help

Your council has special funds to help the families in hard times. They provide grants for essentials such as beds and cookers, which they never pay back. Miscellaneous winter fuel assistance, school lunch vouchers, and housing are on demand. The templates can seem tough. However, employees can advise you on every step.

Speak to the Benefit Adviser

Free money sits unclaimed by thousands who don’t know they qualify. You may get a benefit check where you may not have participated in the process. The job centres, advisers, and community hubs advisers are familiar with the system in and out. They see loopholes in your arguments that would lead to an increase in your income weekly.

Look at Charity Grants

Many organisations provide small grants to needy parents. They assist with chores, including the kids, up to repairing your boiler. Their money tends to go to waste since people are not aware of how to request.

Ask Utility Providers for Support Schemes

Gas, electric, and water firms all run help plans for struggling customers. They might freeze your bills during winter or cap what you pay. Some even clear old debts if you keep up with new payments. A quick call could cut your monthly costs by more than a third.

If You Decide to Take a Loan

Your goal should be minimal debt that causes minimal stress. You can pick lenders with FCA approval stamps on their websites. This means they follow strict rules about how they treat you. You can avoid any firm that rushes you or makes grand promises.

Read every fee before you sign any loan papers. Hidden costs lurk in the small print of many quick loans. Some add fees for early payment, while others charge for sending letters.

You can choose the lowest monthly payment your lender will accept. Small payments over longer times might cost more, but keep you eating well. Your family needs food on the table more than a quickly cleared loan. You can calculate what you can spare against your daily needs.

Avoid offers to roll over your debt to the next month. This trap makes small loans grow into huge money problems. One missed payment becomes six months of mounting fees and stress.

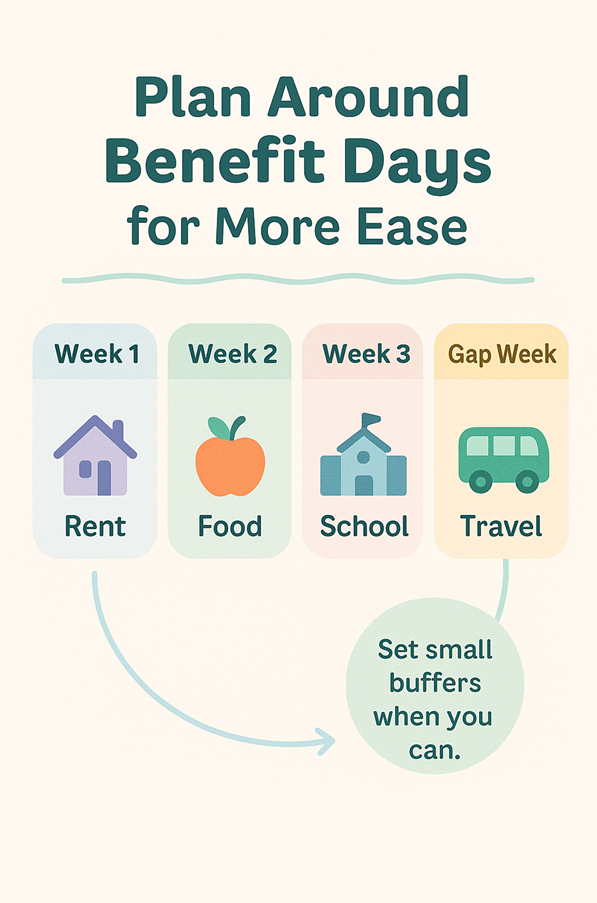

Set phone alarms for three days before each payment date. This gives you time to move money around if funds run short.

| Signs You Should Avoid a Loan | |

| Sign | Meaning |

| no repay plan | too risky |

| bills unpaid now | more strain |

| offer too easy | hidden cost |

| lender unclear | unsafe |

Conclusion

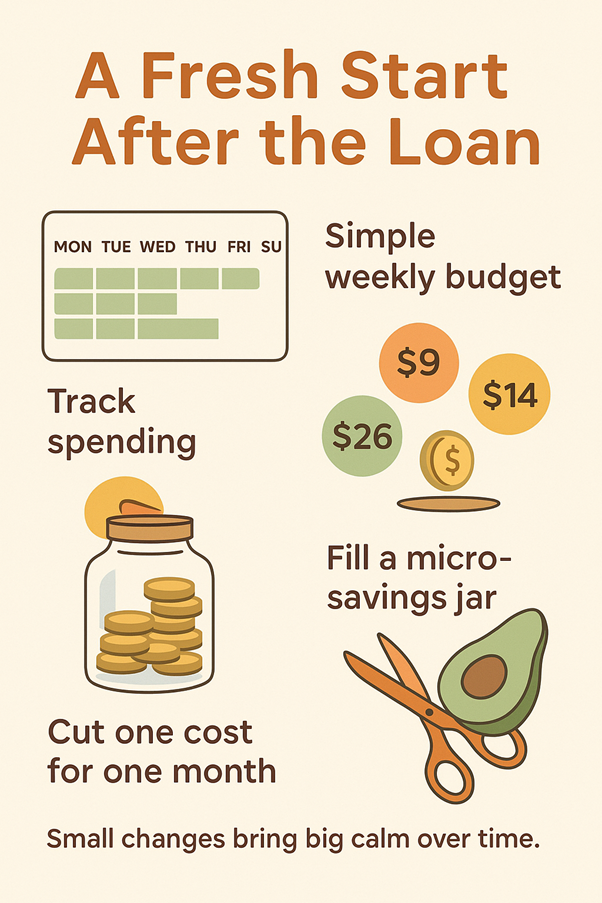

Your family deserves support without the weight of high-interest debt. You can take small steps today rather than facing bigger problems tomorrow. You can call your council, check benefit rights, or talk to bill providers first. These calls could save you hundreds in loan costs and fees.

Your worth isn’t tied to money troubles or tough choices. Many have walked this path before and found their way through. With the right info and careful steps, your family can weather tight times.