October 4, 2025

Using Bad Credit Loans To Settle Small Business Side Hustle Expenses

By : Ellie Brown

Many people now run small businesses on the side for more cash. The drive for extra funds grows as main job pay stays flat. Some people start these small tasks to pay basic bills. The path from side work to full-time grows clearer each year. Most side jobs start small but can grow with the right care.

Side jobs mean you must learn the ways of small firms fast. The rules and paths of big firms do not work on a small scale. Some tasks need new tools or skills that cost cash up front. The tax forms and laws change based on what you earn. Those who plan for both good and hard times do best.

Loan Types for Small Firm Needs

Loans help smooth the cash path when gaps or needs show up. The right cash help means you keep work workflow smooth and clean. Some side firms grow much more when they get funds at key times. The right loan type must match your side job and cash flow. Most loans work best when viewed as tools, not last hope fixes.

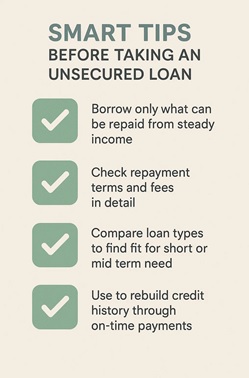

Some firms use unsecured loans for bad credit when the need arises. These loans look past old bill slips to see real firm strength. Your past marks might mean less than your company growth signs. The cash flow and real sales count more than old bank marks. Most loan firms now check full firm health, not just old scores.

Why Side Hustle Costs Pile Up?

Side work may seem inexpensive to start, but its costs escalate quickly. Most small tasks need more cash than you first think. The bills come due while sales take time to build up. Your plans need to shift as real costs become clear. Small jobs can eat cash just like full-time firms do. The shock of how much things cost hits many new starters hard. What looked like quick money turns into a math puzzle of gains and expenses.

The early months hit cash flow much worse than the later ones. Many side jobs require you to buy things before you can sell. The gap between money paid out and cash coming back feels wide. Your main job pay might not cover all these new costs. Side jobs can strain both time and cash in the first year.

- Stock and supply bills must be paid up front

- Good tools cost more than most first plans

- Online shop and ad fees drain cash fast

- Workspace rent adds fixed costs each month

- Tax help and legal fees catch most unprepared

- Phone and web costs rise with more clients

How Bad Credit Loans Help Cover Costs?

Loans bridge the gap when side job costs rise fast. Many banks say no when past bill marks show low. The small loan firms fill this gap for many side jobs. Your cash needs might not wait for bank forms and checks. These loans move much faster than most bank paths. The loan size matches small tasks better than big bank plans.

Many check your real sales, not just old bank marks. The cost seems high, but it matches the risk they take. Your side job needs a small cash boost to grow. These small sums can mean big gains in the right spot.

- Small loans are still granted with past credit slips

- Loans match the size of your small needs

- Short-term plans fit most side job flows

- Money comes just when bills pile high

- Loan firms see side jobs as real firms

Common Side Hustle Uses for Loans

Side jobs need cash for a wide range of bills. Most spending goes to tools and goods that help work grow. The right spending at key times can mean big gains. Your cash might be best spent on what earns back fast. Small firms grow best when money goes to the right spots. The key lies in knowing which costs will help you gain more soon.

|

Feature |

What It Means |

Why It Matters |

|

Easy approval |

Few checks, less focus on credit score |

Gives access to those with poor credit |

|

Small loan amounts |

Usually offered in lower sums |

Keeps repayments manageable |

|

Quick processing |

Funds are released in a short time |

Useful for urgent expenses |

|

Higher eligibility range |

More people can apply |

Wider support for varied cases |

Some firms use guaranteed acceptance loans when banks say no. These loans help when you need cash now, not next month. Your past marks mean less than your firm plans here. The path stays clear when you match loan size to real needs. Most side jobs need just small cash boosts to grow well.

- Raw goods for craft work must be bought

- Ads and web work help reach new buyers

- Tools and work gear need prompt cash funds

- Space rent must be paid right on time

- Packing and post costs rise with more sales

- Course fees help learn skills for growth

Gains for Borrowers from Such Loans

Loans keep your workflow smooth when cash runs tight. Many side jobs grow much faster with the right cash help. The small boost helps cross gaps that might stop growth. Your time stays on work tasks, not just bill stress. Small firms need both skill and cash to reach full size. The calm that comes from paid bills shows in your work. Clients sense when you feel rushed or stressed about money.

The best time to seek loans comes when growth feels near. Many small tasks show signs of growth right when cash dips. The main goal is growth, not just bill help. Your path should lead to more sales, not more debt. Most side jobs that grow to full firms use loans well. The trick lies in seeing loans as tools, not just quick fixes.

- Work goes on smoothly when bills get paid

- Side jobs can grow toward full-time work

- Good pay helps fix past poor bill marks

- Small bill stress drops with prompt pay help

- Growth chance looks clearer with cash flow

- Cash needs match with each growth phase best

Conclusion

Small firms face cash needs that big firms might not see. The tools you need cost much the same for small or large firms. Some costs show up right when your cash reserves are low. The fees for help with tax and law rules mount up fast. Most small firms lack the cash piles that large firms keep.