September 9, 2025

What Is Debt Consolidation and How Does It Work?

By : Ellie Brown

Millions of households today are burdened by debt. Many individuals can be seen dividing their money into five or six estimates per month. This generates a worry of always being due and paying late.

Debt consolidation loans offer a clear way out for many borrowers. This is the simplest rationale, which is fully logical: put all those individual debts together into one loan.

The advantages are usually more than convenient. A large number of individuals obtain reduced interest rates through consolidation. This may be paying less in the long run, where cash flow is relieved in the monthly financial statements. A person who pays 24 per cent on store cards could decrease to 9 per cent on a consolidation loan.

This blog will explain all the ins and outs of debt consolidation. It will help the borrowers to approach the process promptly with the right steps.

|

Debt Consolidation vs. Doing Nothing | ||

|

Feature |

With Debt Consolidation |

Without Debt Consolidation |

|

Number of payments |

One |

Multiple |

|

Interest rate |

Lower |

Higher |

|

Stress level |

Reduced |

High |

|

Risk of missed payments |

Lower |

Higher |

|

Credit score |

Can improve |

Can worsen |

What Is Debt Consolidation?

Debt consolidation loans offer a way out by rolling all your debts into one manageable loan., You make just one payment each month instead of keeping track of five different credit card bills, two store cards, and a personal loan.

The process works by taking out a new loan to pay off your existing debts. This loan comes with a lower interest rate than what you’re currently paying. Many people save hundreds of pounds yearly through this.

The high street banks, credit unions, direct lenders, and online finance companies offer these loans. Some might charge fees, while others have no upfront costs.

One payment date means no more missed deadlines or late fees. Your money stress drops when you’re not constantly checking different due dates and amounts. How do these loans reduce your financial stress?

- Helps improve credit score with regular payments

- Often reduces the total amount paid over the loan term

- Can you stop collection calls from multiple lenders?

- Works best when combined with smart spending habits

The borrowers need to have a steady income and fair credit at a minimum.

|

Pros and Cons of Debt Consolidation Loans | |

|

Pros |

Cons |

|

Single monthly payment instead of multiple |

May extend total repayment time |

|

Often lower interest rate than credit cards |

Might require collateral (like your home) |

|

Fixed payment amount makes budgeting easier |

Application process can be lengthy |

|

Clear timeline for becoming debt-free |

Potential fees for loan setup or early payment |

|

Can improve credit score over time |

Might need good credit to qualify for the best rates |

|

Stops collection calls from multiple creditors |

Doesn’t address underlying spending habits |

|

Simplifies financial management |

Can give a false sense of financial progress |

|

May reduce total interest paid |

Home equity loans risk your property if you default |

|

Eliminates juggling various due dates |

Some lenders charge hidden costs |

|

Can lower the monthly payment amount |

Temptation to rack up new debt after consolidating |

Types of Debt Consolidation

There are many options to settle your debts. Your choice depends on your credit score, how much you owe, and what assets you have. Here are the options for you:

Personal Loans

A personal loan from a direct lender remains the most common approach. You borrow enough to cover all existing debts, then make one payment monthly. The fixed interest rate makes budgeting simpler and more predictable. Most personal loans have a three to seven-year term with no need for collateral.

Balance Transfer Cards

These special credit cards let you move balances from high-interest cards. Many offer zero per cent interest for an intro period, typically 12-21 months. This interest-free window gives you time to pay down the principal. You just need to be aware of transfer fees that usually range between 3%-5% of the moved amount.

Home Equity Options

A home equity loan turns your property’s value into cash for debt clearing. These secured loans offer lower rates because your house serves as collateral. Your home could face repossession if payments stop.

Debt Management Plans

These plans don’t involve new loans but reorganise what you owe. A counsellor works with creditors to reduce rates and fees. Debt settlement might be offered as part of these plans, where you pay less than the full debt amount.

How Debt Consolidation Works?

First, you apply to a lender who reviews your credit history. Once approved, your new lender pays off your existing debts directly, leaving them settled in full.

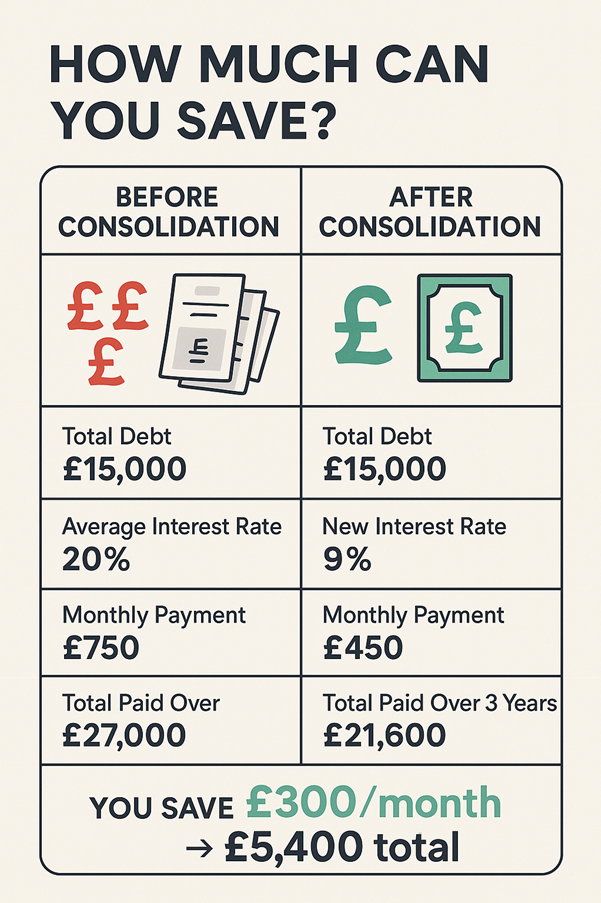

This shifts your duty to just one creditor instead of many. The new loan often carries a lower interest rate than your old debts. This happens because revolving credit typically comes with higher rates than fixed loans. Your credit cards might charge 20% while your new loan is at 9%.

You might choose a longer term to lower monthly costs. Or pick a shorter one to clear debt faster despite higher payments. Either way, you gain control over the repayment structure. Your financial life gains clarity with one due date and one amount.

- Helps stop the cycle of minimum payments

- Creates a firm end date for becoming debt-free

- May prevent further credit score damage

- Often eliminates extra fees and penalties

- Can protect important assets from collection

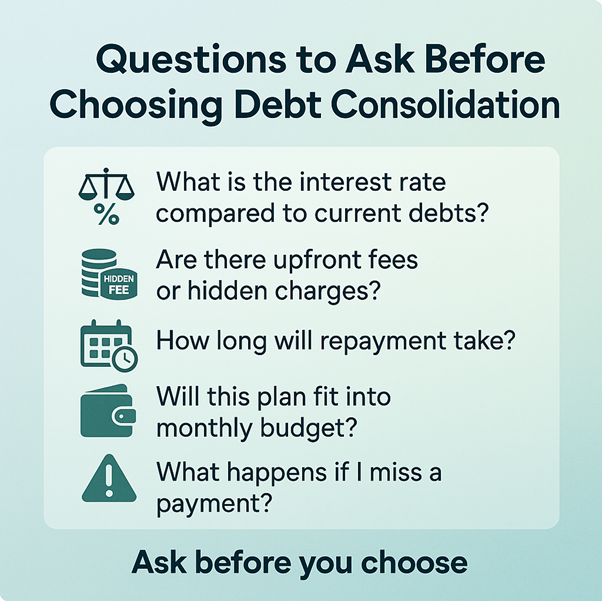

You always check if the new total cost beats your current situation before signing. Sometimes longer terms mean paying more despite lower rates.

|

Debt Consolidation Loan Example | |

|

Item |

Amount |

|

Total debts (3 credit cards + 1 loan) |

£15,000 |

|

Average interest rate (before consolidation) |

20% |

|

New consolidation loan interest rate |

9% |

|

Monthly payment (before) |

£750 |

|

Monthly payment (after) |

£450 |

|

Total savings over the loan term |

£5,400 |

Who Should Consider Debt Consolidation?

Debt consolidation works best for certain situations and borrowers. This might help if you check multiple apps to track payment dates. Those seeking lower monthly outlays often benefit from this approach. This creates breathing room in tight budgets when every pound counts.

Having a good credit score makes a huge difference in what offers you’ll receive. Better scores unlock lower interest rates and more favourable terms. Some lenders require scores above 650 for their best deals.

People with a steady and reliable income are ideal for consolidation loans. The lenders want to see that you can handle the new payment.

These loans can help if you’ve stopped using credit cards and have fixed spending habits. But those who continue piling up new debts while consolidating old ones face a losing battle.

Tips for Successful Debt Consolidation

The process demands careful planning and ongoing effort to fix your money situation. Many people fall short because they skip key steps or return to old habits. You can make sure your consolidation leads to lasting freedom from debt.

- Read any agreement before signing it.

- Install auto-payments to prevent the failure to meet due dates.

- Save some cash in case of small crises. This prevents you from going back to credit when your car starts to malfunction.

- Get moral support by telling the family of your debt plan.

- Review your credit report 3 months after the consolidation. Any mistakes can give an appearance of active old debts.

- Congratulate yourself with small and inexpensive things when you pay your bills.

- Call your lender ahead of time in case you have problems with payments. Most will assist should you contact them before default.

Impact of Debt Consolidation on Credit Score

Many worry about how debt consolidation affects their credit score. Your credit rating will likely see both ups and downs during the process.

You can expect a small drop in your score when you first apply. Each loan application triggers what’s called a “hard inquiry” on your record. This typically lowers your score by five to ten points.

The initial drop fades quickly if you handle the new loan well. Most credit scoring models count several loan searches as just one inquiry when done within a two-week window. This protects people who shop around for the best rates.

After consolidation, closed accounts remain on your record for years. These old accounts marked “paid in full” build positive history. Your payment track record makes up about 35% of your overall score.

The amount of available credit versus what you use plays a huge role. This ratio counts for nearly 30% of your score calculation. The biggest increase comes from making every payment on time. You can set up direct debits to ensure you never forget a due date.

Most people see their scores climb steadily six months after consolidating. The full benefit appears after about a year of on-time payments.

Conclusion

You can take control of your debt, which marks the first step toward financial freedom. Debt consolidation offers a practical tool for those drowning in multiple payments. People who benefit most make firm promises to themselves. They stop using credit cards after consolidating.

The journey requires patience and commitment to new habits. Not everyone finds this path suitable for their situation. You can consider speaking with a free money adviser before deciding. They can review your unique situation without pushing products. The right choice depends on your specific numbers and life goals.